In the midst of discussions about “sustainable energy” and “zero-emission mobility,” India has recently begun focusing on a broad concept known as “net-zero emission targets.” By 2050, the country hopes to achieve its net-zero goal. Mumbai has taken the lead, announcing that it will be net-zero by 2040, a decade ahead of the rest of the country.

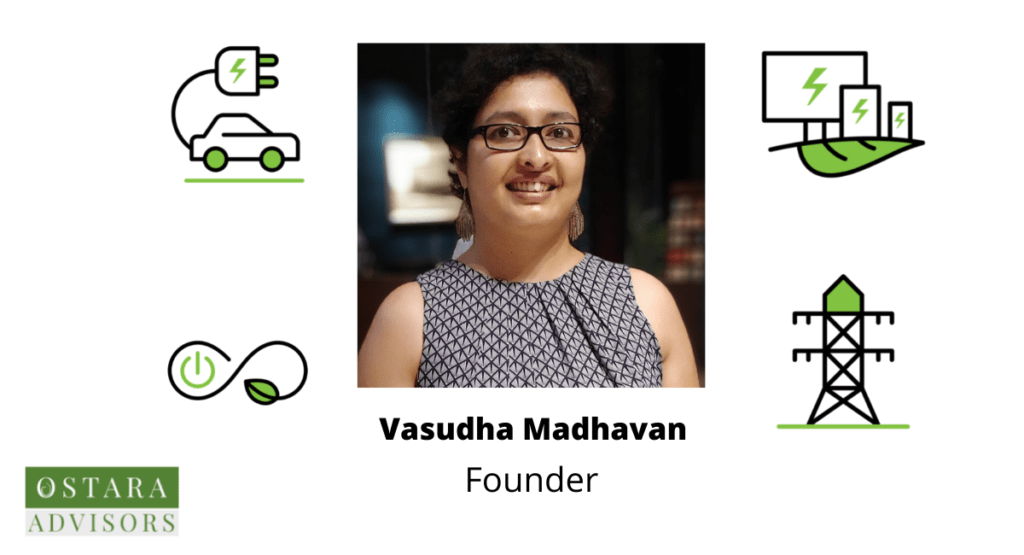

In 2018, Vasudha Madhavan, an investment banker based in Bangalore, saw the potential and founded Ostara Advisors, India’s ‘first’ investment bank dedicated solely to the electric mobility and sustainability sector.

Vasudha and Ostara both defy stereotypes and ‘conventional wisdom,’ with her working in a traditionally male-dominated field and Ostara focusing on a specific niche. Most investment banks, on the other hand, specialize in providing services to a variety of industries. Their individuality can certainly add distinct perspectives to our understanding.

Her Story

Vasudha spent her first six years of life in Chennai, Punjab, and Odisha before settling in Lucknow and enrolling in a school there. “I went to school in Lucknow from kindergarten to tenth grade, after which my family relocated to Bengaluru,” she says. This, she says, helped her develop ‘people skills’ and broaden her cultural horizons.

Vasudha studied at Jamshedpur’s XLRI from 2001 to 2003. “It was my first time away from home, and the experience I gained there changed my life.” She worked for ICICI Bank shortly after graduating from XLRI and lived in Mumbai. She moved to Citibank’s Corporate and Investment Banking team after three years in the structured finance vertical.

Vasudha entered the world of boutique investment banks, which raise capital and provide services to private companies, in 2012. “I decided to work in boutique investment banking during this time when I was being introduced to various VCs.” “This would allow me to focus my efforts on a few key areas,” she explains. Vasudha goes on to say that she has always wanted to be an entrepreneur.

Journey To Investment Banking

“My mother, Sudha Madhavan, is a children’s author and artist. She pushed both my younger sister and me to try new things and ignore gender stereotypes. She’s also been an unwavering supporter of my entrepreneurial endeavors,” she adds.

The Obstacles

“In my line of work, being proficient in the field of corporate finance, as well as being both familiar and conversant with the sector you’re dealing with,” she says.

“I advised a company that was diversifying its mobility business in 2017-18. The company wanted to get into clean mobility, which gave me the chance to research electric two-wheelers.” During this transaction, Vasudha began to consider the space and energy implications of electric vehicles.

Working on what she claims was India’s first EV two-wheeler acquisition transaction provided her with unparalleled experience and insight into the industry. She was also struck by how little she knew about various aspects of the business. “At no point did I want to come across as having half-baked knowledge of the sector,” she said. “It has motivated me to work more and learn faster, in a way,” she says.

Vasudha was motivated to take this step by a personal belief in the electric vehicle space. It was a time when investing in electric vehicles or lithium-ion batteries was uncommon. “I also discovered along the way that I needed to move away from being a generalist because startups and investors interested in this space required a specialized advisor. I was interested in gaining a technical understanding of the electric mobility space and establishing interconnections between various startups,” she says.

The Journey Ahead

The electric vehicle space holds a lot of promise, but we are still at the beginning of the trend, with a lot of gaps to fill. The rate of adoption is the immediate and striking challenge that Vasudha mentions. “More electric vehicles on the road means the overall industry has a chance to grow.” Investors must also begin to see the value in investing in the sector and recognize its potential. If all of this occurs, the ecosystem will undoubtedly expand.”

Vasudha began connecting the dots at a young age. She also emphasizes the need for a more powerful industry voice. “The EV sector’s industry body, like The Confederation of Indian Industry (CII) and Society of Indian Automobile Manufacturers (SIAM), needs a cohesive voice that can bring together all startups as well as incumbents to deliberate on various policy-level changes that might be beneficial,” she adds.

To know more about Ostara Advisors visit their official website at Ostara.co.in

You can also check profiles on Twitter and LinkedIn